Wyoming Businessman Buys GSA Property

/The Client's Story

A gentleman called us after receiving and reading our Straight Talk guides. A retired banking executive, he is a sophisticated investor and a Wyoming resident with an interest in ranching. His ranch, located in southeast Montana and northeast Wyoming, was already under contract. Facing a large income tax bill on his ranch sale, he planned to use the 1031 exchange to defer the tax and downsize into a smaller ranch, and use remaining cash proceeds to further diversify his investments – but he was having trouble finding the right ranch. Intrigued by our Straight Talk guides, he called us to explore other options for a 1031 exchange.

Rolling Up Our Sleeves

While he continued to look for appropriate ranch land, we searched for commercial real estate investments that might meet his goals. He wanted:

A long-term lease with a strong likelihood of renewal

A tenant with strong credit who was likely to make rent payments, on time, through the entire lease term

No management responsibilities

A good location in a stable market

A reasonable return

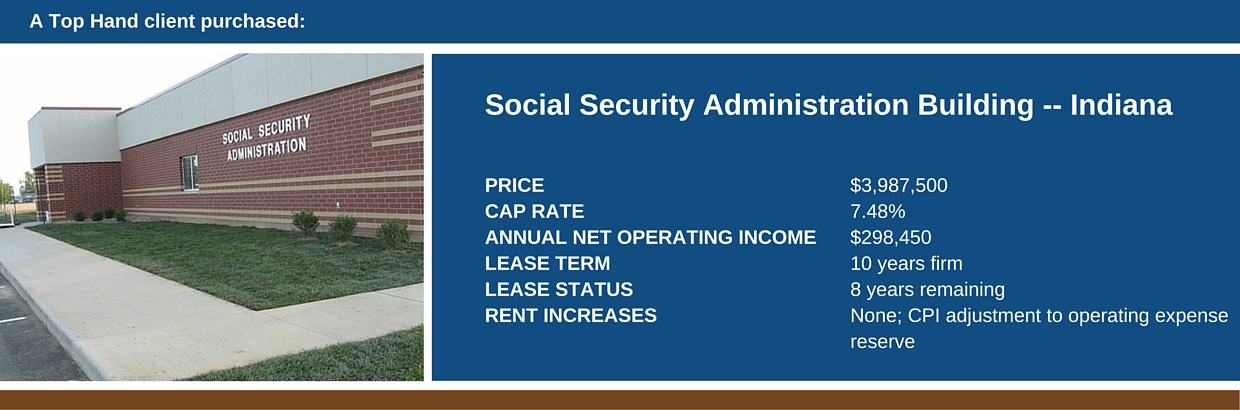

After researching the market, we presented the gentleman with several possibilities based on his parameters, identifying the strengths and weaknesses of each. He zeroed in on four different General Services Administration (GSA) properties that we had sourced from our federal government-leasing network. We began initial due diligence and negotiations on all four, confident that one or two would rise to the top. As expected, we quickly focused on two properties that proved to be the most appealing. Initially, he preferred a Veterans Administration building in Iowa – but our due diligence uncovered a complicated property tax issue, which the seller could not immediately resolve. Thus, both his focus and ours turned to his second-choice property: the Indiana Social Security Administration (SSA) building.

This office building was designed and constructed for the SSA approximately two years before. It offered him the cap rate and high credit quality tenant that he wanted, with eight years remaining on the firm term of the lease. Federal government agencies historically have had very high renewal rates and very long-term tenancies. Located in a market with a sizable population base, the office services a broad surrounding geographic area. The 14,000-square-foot building sits on a 1.5-acre parcel, which is sited on a primary commercial corridor in the new, developing part of town. The site possesses excellent access, visibility and parking.

After a contract was finalized, we dug deeper into our due diligence, examining the lease documents, environmental report, property survey, property financial statements, market demographics and more. Throughout the entire process, we reviewed our findings with our client and his attorney. We effectively managed our client’s 1031 exchange to ensure all time limits were complied with, and had suitable backup properties identified in case the subject property fell through.

As the final step in our due diligence, we conducted a site visit with our client, touring the property itself and exploring the surrounding area. Finally, prior to closing on the property, we introduced him to a professional property management company that specializes in managing GSA buildings, which he later contracted to manage the property for him.

Bottom Line

Our client used the Section 1031 exchange to reinvest a portion of his ranch sale proceeds into a high quality commercial property that met his original requirements. In so doing, he avoided paying a considerable amount of income tax and now owns an SSA building with a lease guaranteed by the U.S. government that produces nearly $300,000 in annual income.

We've provided this information for general educational purposes. It is not intended as specific tax or legal advice. Please consult a professional for specific advice regarding your particular situation.

© 2016 Jack Sauther & Diana Sauther