Wyoming Businessman Part 3: Diversifies with Multi-Family Property

/The Client's Story

This Wyoming gentleman was an existing client of Top Hand. He had previously purchased a Social Security Administration (SSA) building in Indiana through a 1031 exchange after selling a ranch, and later used available cash to purchase a national restaurant chain’s ground lease property in Iowa. His goal now was to further build and diversify his commercial real estate portfolio using available cash and modest financing.

Rolling Up Our Sleeves

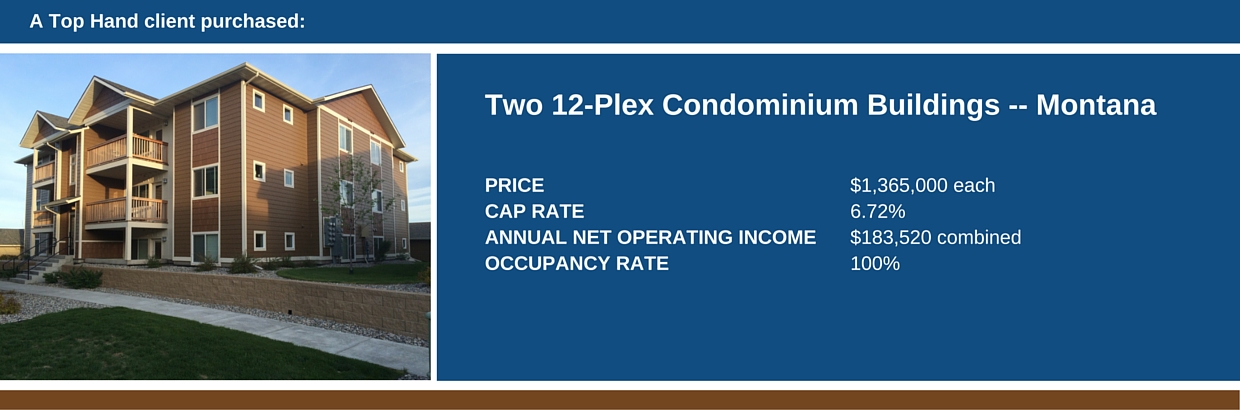

His goal was to diversify by both location and property type. Our search quickly led us to two brand new 12-plex condominium buildings that were under construction in Bozeman, MT. These buildings were part of a larger development consisting of 12 buildings on 10 acres of ground. The location was exceptional – close to a primary commercial corridor, with easy access to other areas of town, and yet off the beaten path enough to provide some peace and quiet. It was within walking distance to day-to-day necessities such as groceries, coffee shops, restaurants and other shopping opportunities, as well as a neighborhood park. In addition to the two 12-plex buildings, the sale included detached garages – one garage unit for each condo.

As we embarked upon our due diligence, we examined the local rental market and interviewed the developer, the manager of the homeowner’s association and a potential property management company to handle the day-to-day management responsibilities for our client.

Bozeman has historically been a strong residential rental market, and was experiencing rapid growth in population, housing starts and record-high enrollment at Montana State University. The vacancy rate around town was near zero. This development was far enough from MSU that the tenants tended to be young professionals, rather than college students. All of these factors appealed to our client and supported his investment decision.

Due to the high rental demand locally, the property management company was certain that they could have both properties leased up upon completion of construction. We prepared cash flow and net operating income projections, which showed that the investment return would be satisfactory to our client.

He decided to purchase two of the buildings, and hired the property manager we had interviewed. As expected, the property manager leased all units in both buildings before construction was finished. This allowed our client to avoid the potential lease-up risk of purchasing two new buildings and then having to find tenants.

Bottom Line

The addition of the two condominium buildings was another step in growing and diversifying our clients’ commercial real estate portfolio. At this stage he owns four different properties diversified by property type and location. Assuming stable occupancy, these two condo buildings should provide him with additional annual net operating income of more than $180,000.

We've provided this information for general educational purposes. It is not intended as specific tax or legal advice. Please consult a professional for specific advice regarding your particular situation.

© 2016 Jack Sauther & Diana Sauther