Wyoming Businessman Part 4: Cashes in Condo for Retail Property

/The Client's Story

This Wyoming gentleman was an existing client of Top Hand. He hired us to help him acquire a diversified portfolio of commercial properties, and had already purchased four separate properties: a federal leased office building, a ground leased restaurant property and two condominium buildings, in three different states. The properties were purchased with 1031 exchange proceeds from a ranch sale, and a combination of available cash and modest bank financing.

Since his purchase of the two 12-plex condominium buildings in Bozeman, MT the year before, the properties had appreciated in value. After consulting with Top Hand, he decided to capitalize on the market upswing, and sell one of his condo buildings and complete a 1031 exchange into another commercial property.

Rolling Up Our Sleeves

As fate would have it, we had another client who wanted a multi-family property in Bozeman. They were selling their eastern Montana cattle ranch in order to downsize and move closer to their Bozeman-based kids and grandkids. They liked the diversified tenant structure of a multi-family building, and wanted something local that they could keep an eye on. With cooperation from our Wyoming client, Top Hand represented the buyer on this transaction and we quickly negotiated a mutually agreeable purchase and sale agreement.

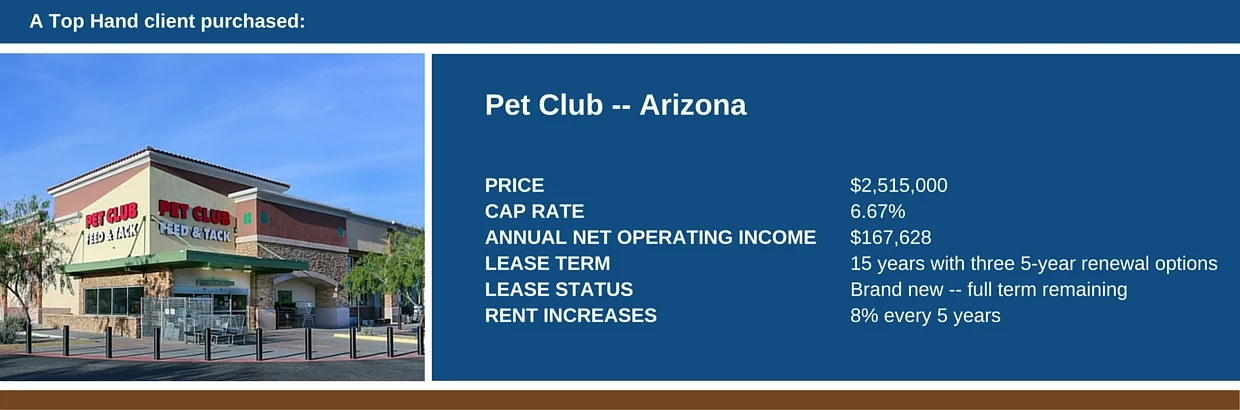

Meanwhile, we began searching for suitable exchange properties for our Wyoming client that would meet his goal of building a diversified portfolio of commercial real estate. After analyzing and presenting multiple promising properties, our client focused on a Pet Club store in Phoenix, AZ. Pet Club is a successful Mesa, AZ-based pet food company that has been in business since 1982, and has over 60 stores in Arizona, Colorado and Texas. A family-owned and operated business, they have a very loyal following in Arizona, and are the preferred pet food store over the larger national companies in this market.

Our client found the location of the Pet Club property particularly appealing, as he owns a second home minutes away and knows the neighborhood. Located on a hard signalized corner on a busy commercial corridor, the large 2-acre site and 14,000-square-foot building has exceptional access and visibility, and a tremendous amount of parking. The brand new, 15-year lease offers the owner significant flexibility when it comes to the holding period and future sale decisions. The lease is a double-net (NN) lease, requiring that the landlord be responsible for certain costs associated with the building’s roof and structure. After an inspection revealed the building to be in excellent condition, and with a 20-year roof warranty in place, our client was willing to accept the NN lease for the higher cap rate.

After a purchase contract was in place, we immediately began our due diligence, examining the lease documents, environmental report, property survey, building inspection report, market demographics, preliminary title commitment and the conditions, covenants and restrictions (CCRs) that govern the property. We vetted the tenant, examining its ability to fulfill the lease obligations. Throughout the process, we reviewed our findings with our client and his attorney. We effectively managed our client’s 1031 exchange to ensure all time limits were complied with, and had suitable backup properties identified in case the subject property fell through. Our final step was to conduct a site visit with our client. Pleased with what he saw, our client purchased the property.

Bottom Line

With his purchase of the Pet Club property, our client successfully accomplished his goal of building a portfolio of commercial real estate that is diversified by property type and location. He now owns a federal government-guaranteed Social Security Administration building in Indiana, a corporate-guaranteed national restaurant chain ground lease property in Iowa, a 12-plex condominium building in Montana and a corporate-guaranteed retail property in Arizona. Together, the properties provide him with a very comfortable amount of net cash flow for his retirement and investing needs. He has minimal property management responsibilities – Top Hand helped him find professional management companies to manage the government and condo buildings, the NN retail lease requires little management, and the NNN ground lease requires the tenant to perform all management and maintenance. Further, the lease terms are staggered with different expiration dates, so he may expect continued steady income from the other properties in the event that a lease expires and the tenant leaves. All in all, he has built a strong, stable portfolio of properties that should provide him a very comfortable retirement.

We've provided this information for general educational purposes. It is not intended as specific tax or legal advice. Please consult a professional for specific advice regarding your particular situation.

© 2016 Jack Sauther & Diana Sauther